To ensure the safety of your eWallet transactions, follow these essential security practices. Always use a strong password and enable two-factor authentication to protect your account from unauthorized access.

Regularly monitor your transaction history to detect any suspicious activity early. Additionally, avoid using public Wi-Fi networks for financial transactions to protect your data from being intercepted. Lastly, update your security settings frequently and follow best practices for app privacy. By adopting these security measures, you can enjoy a secure and stress-free digital payment experience.Ensure the security of your eWallet by using strong passwords, enabling two-factor authentication, and monitoring transactions regularly. Always avoid public Wi-Fi when making financial transactions, and only connect your eWallet to trusted apps.

"Protecting your eWallet is essential for secure transactions. Always use strong passwords, enable two-factor authentication, and monitor account activity regularly. Keep your device's software up-to-date and avoid public networks.”

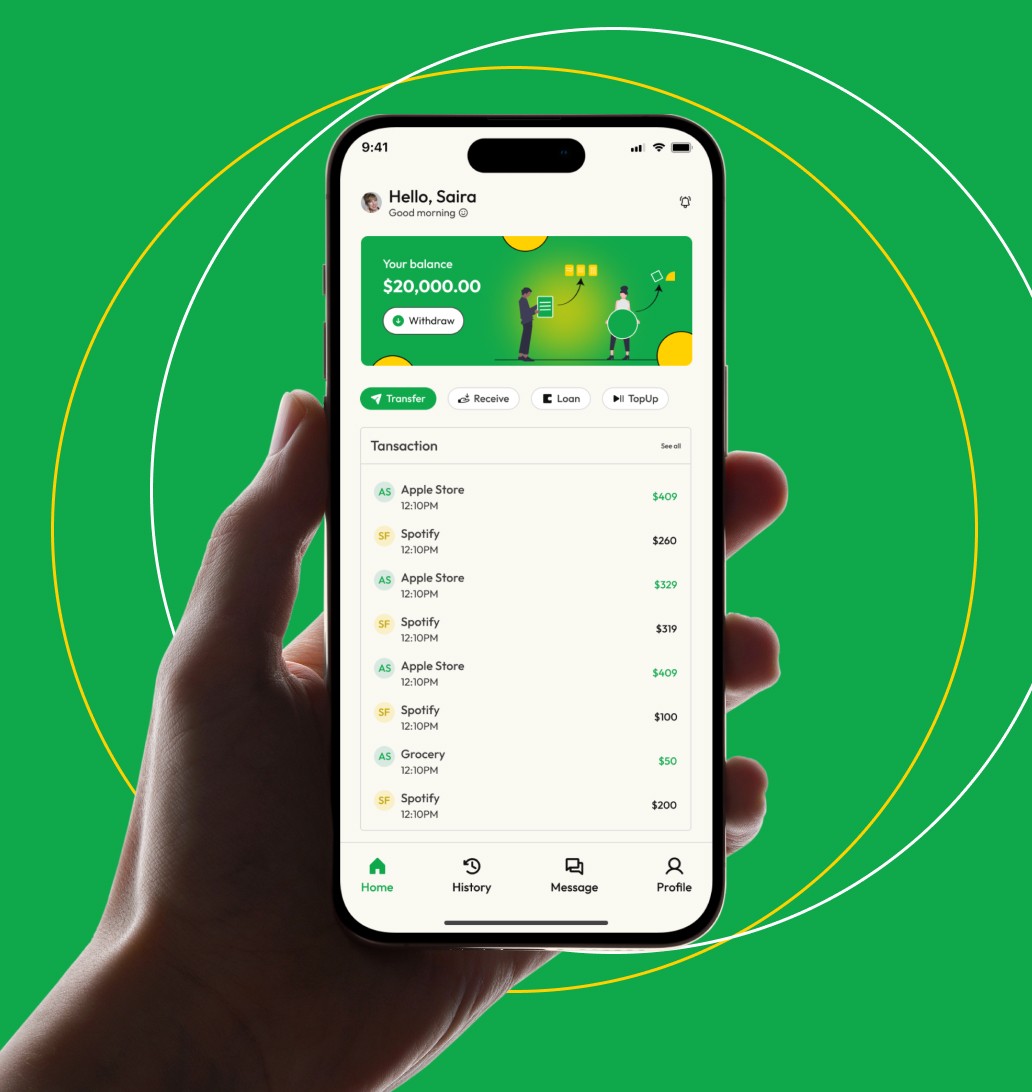

Understanding Safe eWallet Transactions

In today’s interconnected digital world, understanding and implementing robust security practices is crucial to safeguard sensitive information, maintain system integrity, and foster user trust. Effective security begins with data protection, using encryption to secure data in transit and at rest, while access control ensures that only authorized individuals can access critical systems.

Safe eWallet

To ensure safe transactions, always use secure networks and enable two-factor authentication on your eWallet.

Secure Transactions

Payment Safety

Fraud Prevention

Digital Security

Step-by-Step Guide to Safe Transactions

Start with risk assessment, enforce strong passwords, update software regularly, implement firewalls, train employees, back up data, monitor for threats, and comply with industry standards. Stay secure!

Safe Transaction

Ensure your transactions are protected by using trusted platforms and secure payment methods. Regularly monitor your accounts for any suspicious activity.

Secure Payments

Fraud Prevention

Set Up Security

Trusted Platforms

Tips for safe safe transactions

Use strong, unique passwords for accounts.

Enable two-factor authentication for extra security.

Regularly monitor transaction history for suspicious activity

Use trusted payment gateways for secure payments.