Mastering personal finance strategies is essential for achieving financial stability and long-term success. By establishing a clear budget, tracking your expenses, and setting realistic savings goals.

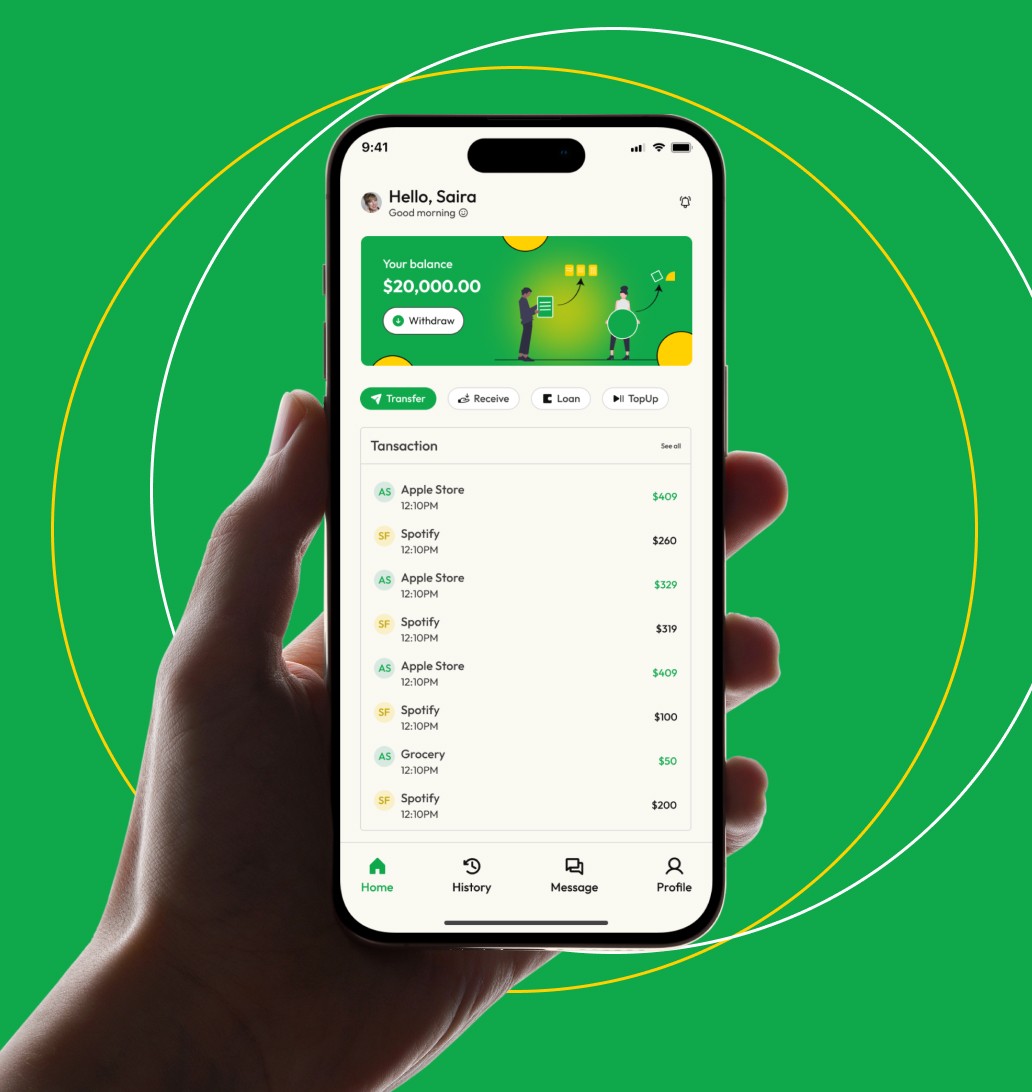

A solid strategy includes prioritizing high-interest debt, automating savings, and investing wisely to grow your wealth over time. Planning and discipline are key to building a strong financial foundation. Additionally, building an emergency fund and understanding your credit score can significantly impact your financial health. Regularly reviewing your financial situation and adjusting your strategies as your life changes ensures that you stay on track toward your financial goals. With the right approach, you can make informed decisions and achieve greater financial freedom.By continuously educating yourself on financial trends and using tools like budgeting apps and digital payments.

“Mastering personal finance is not just about saving money, but making smart choices that lead to long-term security. Prioritize your financial goals, plan for the future, and always be proactive in managing your resources. ”

Mastering Personal Finance

Understanding personal finance is key to achieving financial independence and security. It involves budgeting, saving, investing, and managing debt wisely. By learning how to allocate your money effectively, you can build wealth and achieve your financial goals. Start by tracking your expenses and setting clear, realistic financial targets.

Personal Finance

Personal finance is the management of your income, expenses, and savings to achieve financial security.

Investment Strategies

Budgeting

Tech Innovations

Investing

Comprehensive Personal Finance Guide

Personal finance management doesn’t have to be complicated. This step-by-step guide helps you set financial goals, create a budget, and track expenses effectively. Learn how to manage your savings, investment, and debt for a secure future. Stay on top of your financial health with clear steps to achieve financial independence.

Budgeting for Success

Creating a budget is the foundation of good financial management. It helps you track your spending, save for future goals, and avoid unnecessary debt. With simple tools and strategies, you can allocate your money wisely.

Smart Budgeting

Debt Management

Goal Setting

Financial Health

Tips for safe personal finance

Regularly monitor accounts for unauthorized activity.

Use strong passwords and multi-factor authentication.

Diversify investments to minimize financial risks.

Maintain an emergency fund for unexpected situations.